As details are rolling out about the Section 232 sanctions on steel and aluminum products, the impacts to current construction costs have been swift and severe. The original announcement by the Trump administration on May 31st was anticipated to be in the form of tariffs only and would exclude the countries of Canada and Mexico. The evolving details appear to be more austere than anticipated. Not only are Canada, Mexico and the Eurozone subject to tariffs, Korea, Brazil and Argentina are under prescribed quotas for key products. Many of the quotas are filling up quickly. The one quota filled this week ranks among the largest quotas of all steel products: “Bars and Rods Hot-rolled” from Brazil. After nearly 100,000 metric tons imported this year, the product has reached its limit and can no longer be imported. More quotas are expected to hit their limits by the fourth quarter.

In addition, The Office of United States Trade Representation (USOTR) recently enacted a 25% tariff on over 1,100 categories of goods produced in China, impacting over $50 billion in goods imported to the US. The impacts of the Chinese tariffs have yet to hit the market. The final list of items remains to be determined and are in the appeal process. One interesting note about Section 301 sanctions is the tariff is determined by the specified part country of origin, not of assembly. So, for example, a backhoe or truck imported from Japan partially assembled with Chinese parts could be subject to some portion the Section 301 tariffs depending on the parts utilized.

Impacts to U.S. Construction Costs

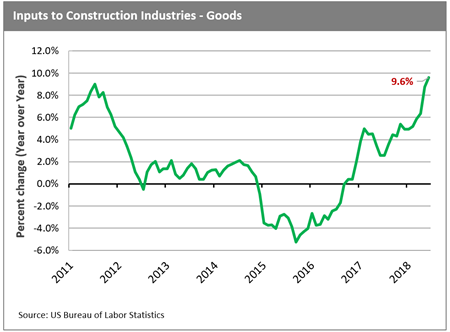

While the U.S. economy appears to be humming along with 4% GDP growth in the second quarter, domestic construction material prices are mirroring the economic trend. Construction costs accelerated again in June, with steep increases for a wide range of building and road construction materials as tariffs and quotas against foreign goods come into effect, according to an analysis by the Associated General Contractors of America (AGC) and new data from the Bureau of Labor Statistics (BLS). Contractors’ costs for a wide range of materials and services have escalated dramatically in the past few months. Section 301 tariffs that have been announced since this price data was collected will push costs up even higher.

The BLS producer price index for aluminum mill shapes spiked 20% from June 2017 to June 2018, 17.4% for copper and brass mill shapes, and 12.3% for steel mill products for the same period. Other construction inputs that rose sharply during this period include lumber and plywood, 18.3%; asphalt felts and coatings, 7.5%; ready-mixed concrete, 5.5%; paving mixtures and blocks, 5.0%; and diesel fuel, 58%. The BLS producer price index for Inputs to Construction Industries-Goods (a measure of all materials used in construction projects including items consumed by contractors) shot up 9.6% over the last 12 months. The year-over-year increase was the steepest seen since October 2008.

Summary

The tariffs and quotas have combined with a heated building market and overall uncertainty to create volatile construction pricing. Clearly the price increases captured by the Bureau of Labor Statistics data exceed the anticipated impacts from new sanctions. While the 9.6% increase tracked by the BLS only applies to material inputs representing 55% to 65% of the typical project construction cost, the remaining costs are under rising price pressure as well. When contractors in busy markets are contractually required to hold pricing through the duration of a project, they will pass on that risk and uncertainty to owners in the form of elevated pricing. Those contractors are faced with uncertain tariff impacts, potential delays due to material allocations, rising energy costs, shipping surcharges, newly negotiated Master Trade Agreements (MTA’s), labor shortages, and resulting loss of productivity. Historically in slower markets and periods, many of these costs would be “absorbed” by contractors willing to accept more risks to procure work in a more competitive environment.

To capture the current volatile conditions, we have revised escalation forecasts for 2018 and 2019. Escalation rates for many of the busier markets have been increased 1.5% to 2.0% for 2018, and 0.5% to 1.0% for 2019. Cumming has formulated strategies in the past to deal volatile markets (such as the 2005-2007 period), while making sure our clients are getting fair market value. Your local Cumming project leader will gladly discuss the specific impacts and potential strategies for your project. If you have any questions regarding this report, please call Bill Rodgers at (916)276-4201, or email brodgers@cccorpusa.com.

About Cumming

Cumming is an international project and cost management firm with 27 domestic and 4 international offices, and approximately 1850+ team members. Since opening for business in 1996, Cumming has provided efficient and cost-effective solutions to ensure that projects in the commercial, hospitality, retail, entertainment, education, healthcare, and high-end residential sectors are executed on time and within budget. Cumming provides a solutions-oriented suite of services that specifically addresses its clients’ unique challenges, thus enabling them to achieve extraordinary results. For more information, please visit www.ccorpusa.com.

Media Contact

For all media inquiries, please contact Jessica Busch by using the contact form below: